October Quarterly Newsletter

- Sep 30, 2020

- 5 min read

Highlights of this Newsletter:

Celebrating 30 years at LVM - David Cleveland and Len Harrison

Surge in COVID-19 Scams

Incapacity and Advance Medical Directives

Working in Retirement

Surge in COVID-19 Scams

Fraudsters and scam artists have always looked for new ways to prey on consumers. Many are now using their tactics to take advantage of consumers' heightened financial and health concerns over the coronavirus pandemic. Federal, state, and local law enforcement have issued warnings on the surge in coronavirus scams and offer advice on how consumers can help protect themselves.

Here are some of the more prevalent coronavirus scams that consumers need to watch out for, along with some tips for protecting yourself from becoming the victim of a scam.

Fraudulent Treatments, Vaccinations, & Home Test Kits

The Federal Trade Commission (FTC) issued warnings about scam artists attempting to sell fraudulent products that claim to treat, prevent, or diagnose COVID-19. The FDA has warned consumers to be wary of companies selling products that are not authorized or approved by the FDA. You can visit fda.gov for more information.

Phishing Scams

Scammers have been using phishing scams related to the coronavirus pandemic to obtain personal and financial information. Phishing scams usually involve unsolicited phone calls, letters, emails, text messages, or fake websites that pose as legitimate organizations and try to convince you to provide personal or financial information. Once scam artists obtain this information, they use it to commit identity or financial theft.

Be wary of anyone claiming to be from an official organization, such as the Centers for Disease Control and Prevention or the World Health Organization. And remember that government organizations, such as the Social Security Administration and the Internal Revenue Service, will never initiate contact with you to ask for personal and financial information, such as your Social Security number. In addition, be on the lookout for nongovernment websites with domain names that include the words "coronavirus" or "COVID-19," as they are likely to be malicious.

Coronavirus-Related Charity Scams

During the coronavirus pandemic, many charitable organizations have been established to help those affected by COVID-19. Unfortunately, scammers sometimes try to pose as legitimate charitable organizations in order to solicit donations from unsuspecting donors. Watch out for charities with names that are similar to more familiar or nationally known organizations such as the American Red Cross.

Before donating to a charity, make sure it is legitimate. Never donate cash, gift cards, or funds by wire transfer. The IRS website has a tool to assist you in checking out the status of a charitable organization at irs.gov/charities-and-nonprofits.

FTC COVID-19 Complaints

Over 60,000 complaints related to COVID-19 were reported to the Federal Trade Commission during the period between January 1 and June 3, 2020, with a total fraud loss of

$45.32 million.

Protecting Yourself from Scams

Here are some steps you can take to help protect yourself from becoming the victim of a scam, including a scam related to the coronavirus pandemic:

Don't click on suspicious or unfamiliar links in emails, text messages, social media feeds and instant messaging services

Don't answer a phone call if you don't recognize the phone number — let it go to voicemail and check later to verify the caller.

Never download email attachments unless you can verify that the sender is legitimate.

Keep device and security software up-to-date.

Maintain strong passwords and use multi-factor authentication whenever possible.

Never share personal or financial information via email, text message, or over the phone.

If you receive a fraudulent email, text or phone call, report it to the appropriate government agency such as the Federal Trade Commission or Internal Revenue Service and your local police department.

Incapacity and Advance Medical Directives

At some point in your life, you may lose the ability to make or communicate responsible health-care decisions for yourself. Without directions to the contrary, medical professionals are generally compelled to make every effort to save and sustain your life. Depending on your attitude toward various medical treatments and your views on the quality of life, you may wish to take steps now to control future health-care decisions with one or more advance medical directives.

What Is an Advance Medical Directive?

The laws of your state may allow you to adopt one or more advance medical directives to manage your future medical care. There are three main types of advance medical directives: (1) a living will, (2) a durable power of attorney for health care, and (3) a do-not-resuscitate order. Each has unique characteristics and is useful under specific circumstances. You may find that one, two, or all three advance medical directives are necessary to express all your wishes regarding medical treatment.

Living Will

A living will is a legal document that specifies the types of medical treatment you would want, or not want, under particular circumstances. In most states, a living will takes effect only under certain circumstances, such as a terminal illness or injury. Generally, one can be used solely to decline medical treatment that "serves only to postpone the moment of death."

Durable Power of Attorney for Health Care/Health-Care Proxy

A durable power of attorney for health care

(DPAHC), also known as a health-care proxy, is a legal document in which you appoint a representative to make medical decisions on your behalf if you become unable to make or communicate them yourself. It allows you to exercise control over your health care through this representative, who will have the authority to make most medical care decisions for you.

Incapacity and Advance Medical Directives

You may want to appoint such a representative to act on your behalf. If you don't, medical professionals will generally be compelled to do everything possible to save and sustain your life. A DPAHC can resolve conflicts and help ensure that your choices regarding medical treatment are respected. A DPAHC may not be practical in an emergency — your representative must be present to act on your behalf.

Do-Not-Resuscitate Order

A do-not-resuscitate (DNR) order is a legally binding order, signed by both you and your physician, that directs medical personnel not to perform cardiopulmonary resuscitation (CPR) or other invasive procedures on you if you stop breathing or your heart stops beating. A DNR is the only advance medical directive specifically intended for use in an emergency. There are two types of DNRs: One is effective only while you are hospitalized; the other is used by people outside the hospital. ID bracelets, MedicAlert® necklaces, and wallet cards are some methods of noting DNR status.

More to Consider

The laws on advance medical directives vary considerably from state to state. If you spend a significant amount of time in a state other than where you live, you may want to research that state's laws as well

Review your advance medical directives periodically to ensure they reflect your current wishes and attitude.

Discuss your advance medical directives with appropriate persons (perhaps your doctor, your DPAHC representative, your family, and your friends).

If you have multiple advance medical directives make sure your instructions are stated consistently throughout. In many states, the most recent document prevails in case of a conflict.

Working in Retirement

In 2020, 74% of workers said they expected to work for pay after retiring from their regular jobs, but only 27% of retirees said they had actually done so. This large gap between expectation and reality has been fairly consistent in surveys over the past 20 years, and there is no reason to expect it will change. So it may be unwise to place too much emphasis on income from work in your retirement strategy.

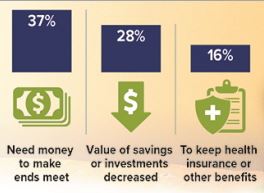

Most retirees who worked for pay reported positive reasons for doing so; however, there were negative reasons as well.

Source: Employee Benefit Research Institute, 2020 (2019 data used for chart, multiple responses allowed)

Comments